Roth ira early withdrawal penalty calculator

This calculator assumes that you make your contribution at the beginning of each year. Ready To Turn Your Savings Into Income.

The Ultimate Roth 401 K Guide District Capital Management

A Roth IRA is an IRA that except as explained below is subject to the rules that apply to a traditional IRA.

. Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. You can withdraw from your Roth IRA at any time but before you make a withdrawal keep in mind these guidelines so you can avoid the potential 10 early withdrawal. Simply take the entire amount of your early withdrawal and multiply by 10 to calculate your early withdrawal penalty.

As a result its subject to income taxes and a 10 Roth IRA early withdrawal penalty. But the remaining 7000 is considered an investment gain. Roth IRA distributions that return your regular contributions also called withdrawals are tax-free and arent subject to the 10 penalty.

Automated Investing With Tax-Smart Withdrawals. The amount of your RMD is calculated by dividing the value of your traditional IRA by a life expectancy factor as determined by the IRS. Withdrawals on earnings from Roth IRAs that are less than five years old are subject to both taxes and penalties.

As an example lets say that youre 35 years old and. In this example multiply 2500 by 01 to. Contributions and earnings in Roth 401 k can be withdrawn without paying taxes and penalties if the account holder is at least 59½ and has kept his Roth.

However given a number of situations listed below it is possible to avoid a. You and your spouse can each withdraw 10000 from your IRAs without paying the 10 penalty if you both qualify as first-time homebuyers. Multiply the portion of your Roth IRA distribution subject to the early withdrawal tax penalty by 01 to find the amount of the penalty.

In a Roth account subtract your total Roth contributions from the. 800-343-3548 Withdraw from your IRA Rules for early withdrawals from an IRA Traditional rollover SEP and SIMPLE IRAs Roth IRAs If you are considering a withdrawal from one of. Get Up To 600 When Funding A New IRA.

The distribution must be used to. The amount you will contribute to your Roth IRA each year. If youre at least age 59 12 when you make the withdrawal you wont pay the 10 early withdrawal penalty.

So assuming a tax rate of 25 you owe. The maximum annual IRA contribution of. You cannot deduct contributions to a Roth IRA.

Before making a Roth IRA withdrawal keep in mind the following. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. Ad Explore Your Choices For Your IRA.

Using this 401k early withdrawal calculator is easy. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. As long as you dont qualify for an exception your penalty is 10 of the entire amount you withdraw early.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. If you take a 10000 distribution you would multiply 10000 by 20000 to get 200000 then divide the result by 100000 to find that 2000 is tax-free. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Ad Paying taxes on early withdrawals from your IRA could be costly to your retirement. To calculate the portion of the withdrawal attributable to earnings simply multiply the withdrawal amount by the ratio of total account earnings to account balance. Roth IRA withdrawal and penalty rules vary depending on your age and how long youve had the account and other factors.

The 72 t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty. Get Up To 600 When Funding A New IRA. This applies no matter how long the money is in the account.

Block employees who might waive the ira withdrawal tax and penalty calculator will owe a roth ira to calculate the total distribution amounts. Use this calculator to estimate how much in taxes you could owe if you take a distribution before retirement from your qualified employer sponsored retirement plan QRP such as a 401k 403b. You can always withdraw more than the.

If you satisfy the. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate. Explore Choices For Your IRA Now.

There are three types of Roth. Detects if a fouryear period begins the tax penalty.

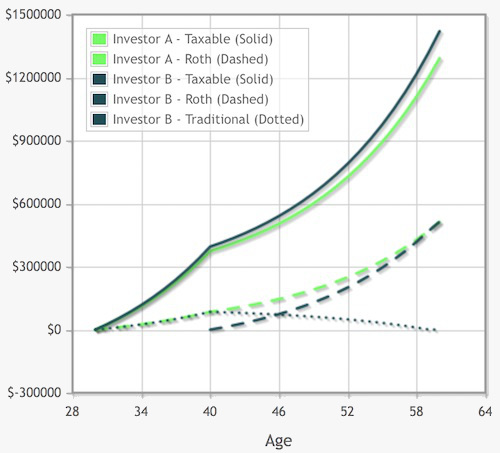

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculator How Much Could My Roth Ira Be Worth

Roth Ira Calculator Roth Ira Contribution

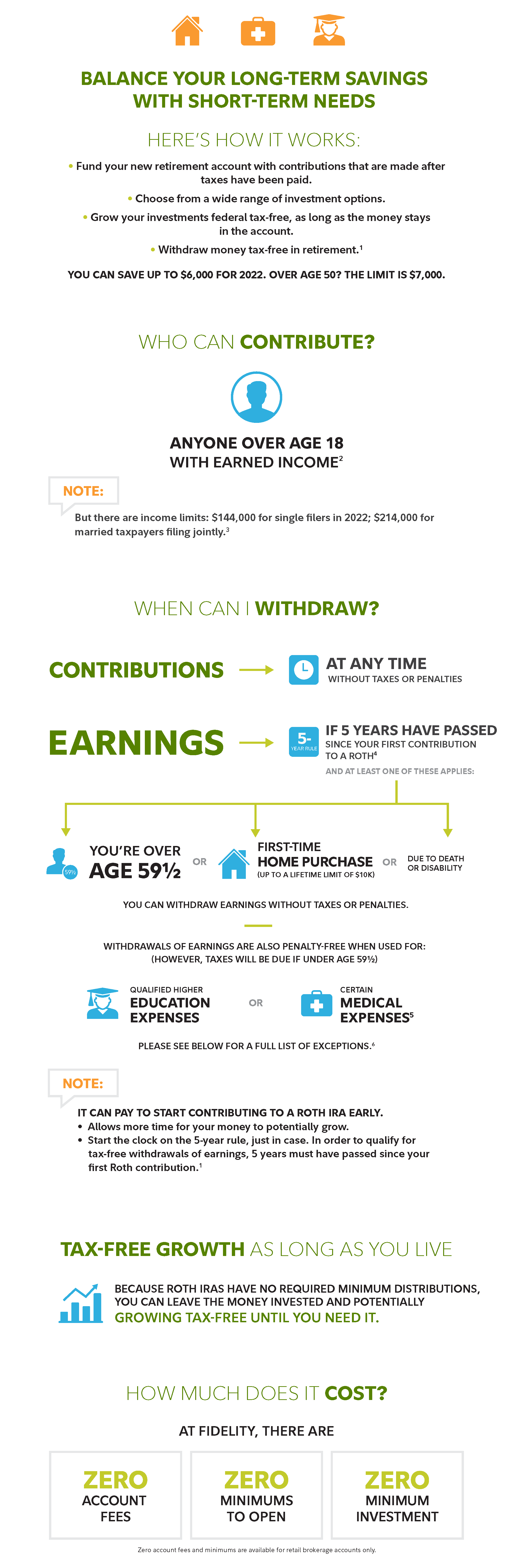

Save For The Future With A Roth Ira Fidelity

Pin On Financial Independence App

Roth Ira Withdrawal Rules Oblivious Investor

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Read About My Favorite Retirement Calculator Firecalc Retirement Calculator Retirement Money Retirement Savings Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

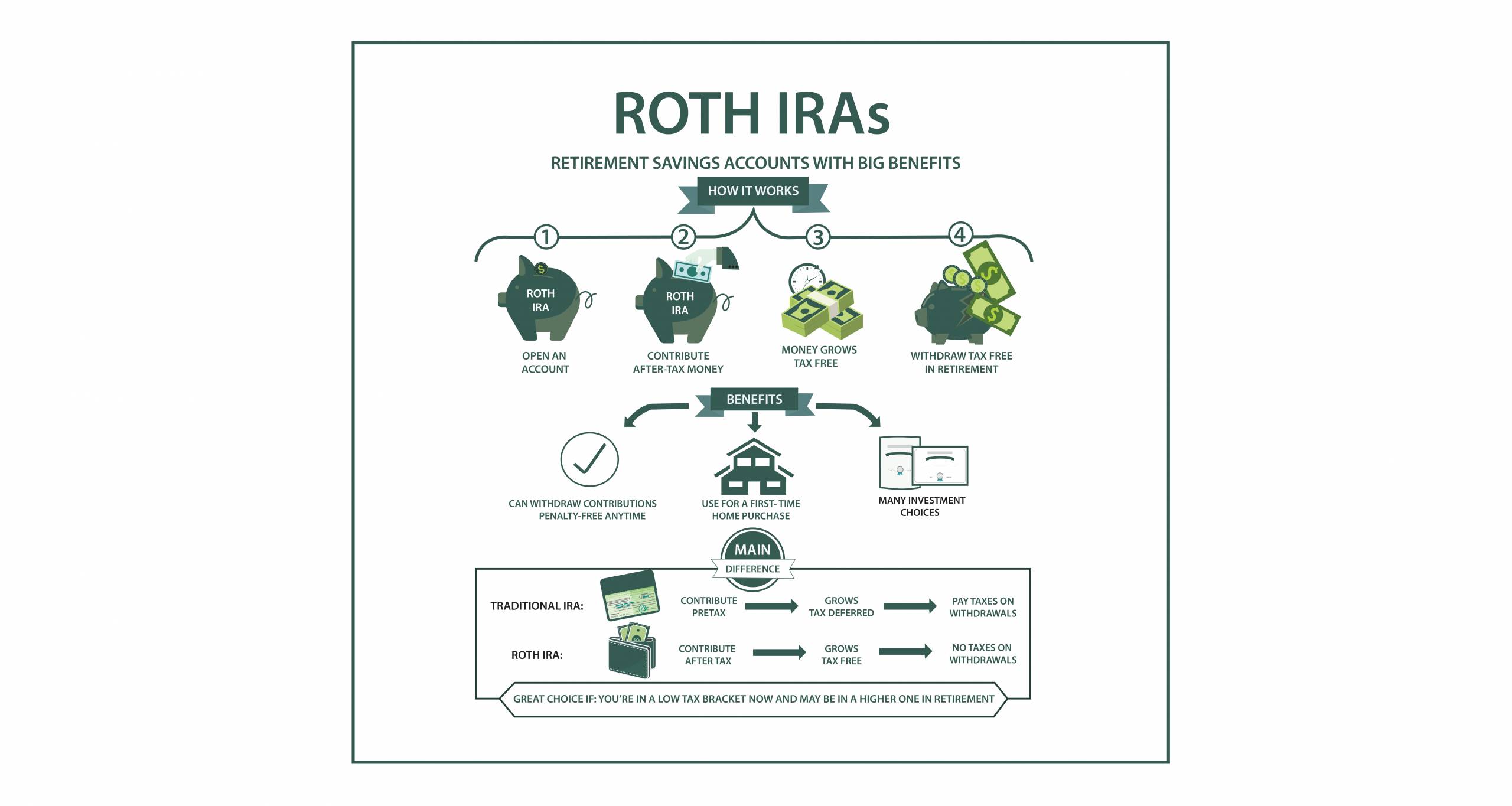

Roth Vs Traditional Ira Key Differences Comparison

The 2 62 Million Roth Ira Due

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement

Traditional Ira Definition Rules And Options Nerdwallet

Understanding Traditional Roth Iras Hills Bank

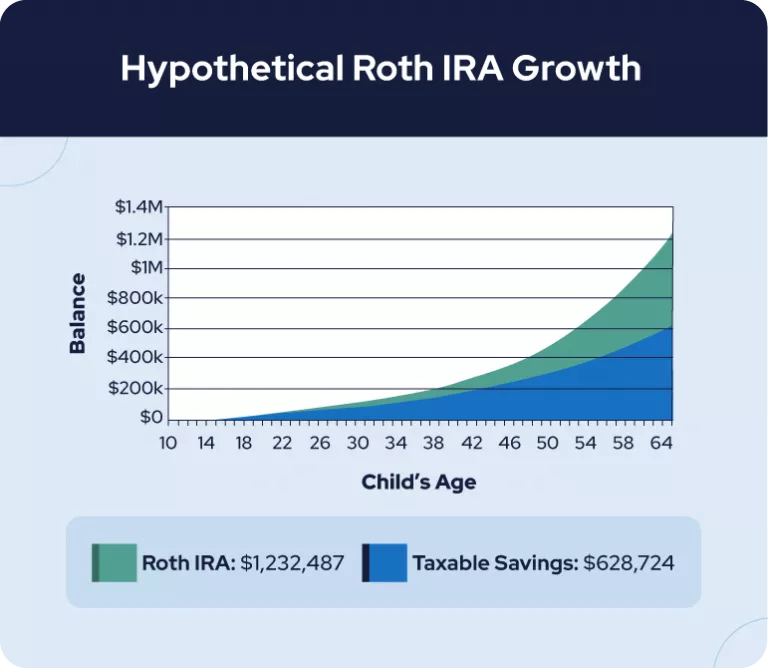

Roth Ira For Kids Rules And Contributions Shared Economy Tax